As market demand continues to rise, demand for copper metals and copper concentrates begins to pick up, with all this good news having an impact on the price of copper metals. Copper metals began to rise slowly as the copper consumer market began to warm up and the use of copper materials began to increase in many industries after entering a break-time low.

Europe and the US fell back in manufacturing PMI data in March, leading to renewed fears of a global slowdown, lower yields on U.S. stocks and US bonds and a sharp rise in the panic index VIX, which led to a correction in commodities such as copper and metal materials and crude oil. German manufacturing PMI fell to 44.7 for three consecutive months, hitting a 79-month low, driving the euro zone's manufacturing PMI to its lowest level since April 2013, while the US Market manufacturing PMI in March was the lowest since June 2017.

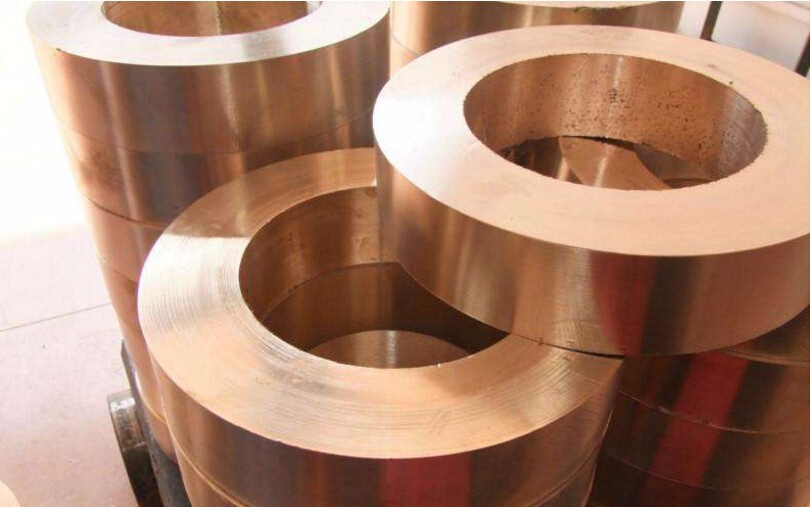

The supply side may drive the low price rebound of copper metal materials, the world's new large copper metal material mines are scarce, and smelting capacity is once again reaching a peak of expansion. Two copper companies signed a 2019 copper-metal material concentrate TC of US $80.8 per tonne, down from US $82.8 per tonne in 2018, indicating market expectations for tight supply of copper and metal materials and minerals in 2019.

Spot TC for imported copper concentrate metal materials continued to decline, averaging $70.5 per tonne for processing fee TC as of March 22. It can be seen that copper and metal concentrate supply was more tight than expected.

In addition, smelter overhauling production is higher than the same period last year, with Chile's national copper and metal material company extending the overhaul time to April, which could actually affect production more than the planned two hundred and eighteen thousand tonnes. On the domestic side, copper metal materials companies also plan to overhaul, which will affect production capacity; on the demand side, April is the downstream traditional consumption season, copper metal material pipe and copper metal material rod enterprises in the start-up rate is at a higher level during the year. Under strong consumption, domestic inventories tend to begin around April, with inventories of copper and metal materials falling by 5429 tonnes to 259172 tonnes on March 22, the first drop in eight consecutive weeks of gains, or the opening of a domestic delisting phase.

Attend exhibitions, focus on industry devolpment trend and new technology,Nexteck Technology Limited keeps pace with the times ,exploring and innovating so as to achieving continuous development.

TAG: Copper Metal Materials